4-H is a

Community for All

Through 4‑H, over 6 million kids take on critical issues like community health inequities, engaging in civil discourse and advocating for inclusion.

Ready For Life

You can help equip kids with essential life skills, confidence, and a deep sense of belonging through epic hands-on learning experiences.

Empowering young people to close the digital divide in their communities.

Inspire young people to participate in STEM through hands-on learning.

Use our search tool to find 4-H clubs, camps, and after school programs.

4-H's online learning platform that helps kids

become more confident, resilient and independent.

We empower kids to take control of their learning

CLOVER helps building confidence, creativity, and life skills in leadership and resiliency to help them thrive, today and tomorrow.

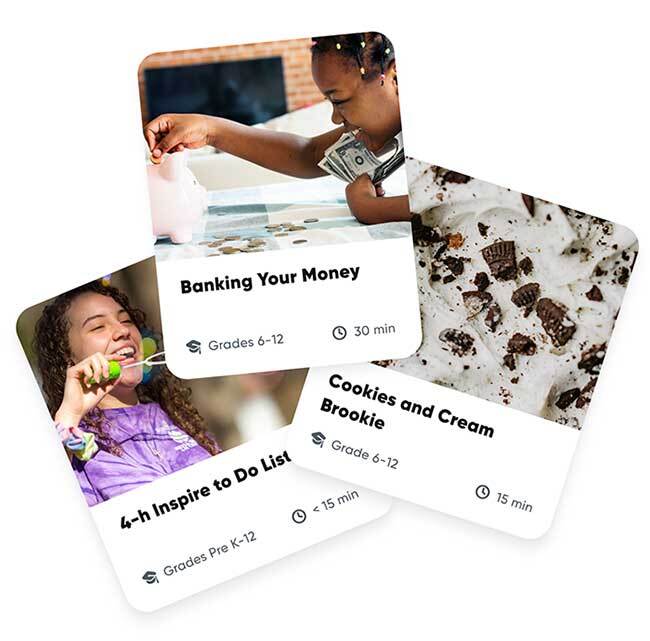

190+ interactive online activities available

CLOVER offers a wide range of activities and courses across Agriculture, STEM, Healthy Living, and Civic Engagement.

Join CLOVER today and help your kids reach their full potential.

Shop 4-H

What´s happening

AT 4-H

Launch into space with CLOVER by 4-H

Ever looked up at the moon and wondered how people get there?

Get started learning by creating a virtual rocket with all it takes to get to the moon, from where you are right now!

Ag Week 2024

Join us in celebrating Ag Week! Are you interested in learning more about ag? Explore some of these awesome CLOVER activities or discover some favorite items on Shop 4-H.

4-H NEWS

The latest news from the 4-H community.